Social media giant Facebook has announced it is launching the Novi digital wallet, a blockchain-based payment system for the e-currency Diem.

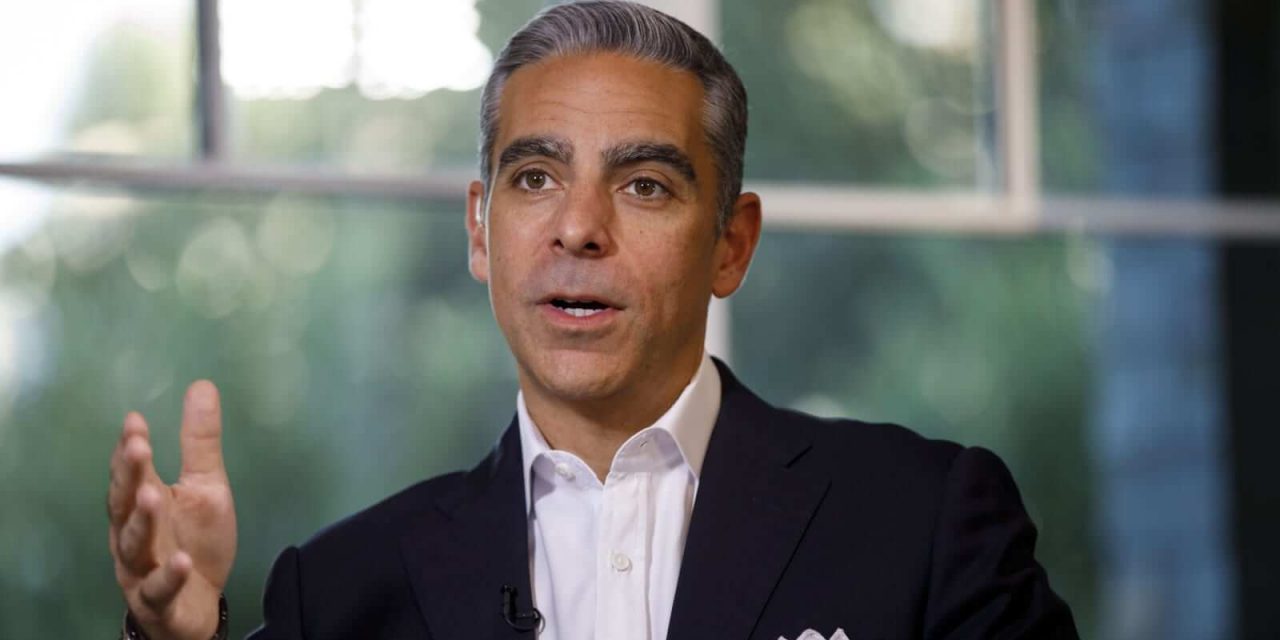

In a blog post published on Wednesday, David Marcus, the chief executive of Facebook’s financial services division, said Novi would potentially play a critical role in improving the global payments system. As it stands, he describes the system as being too inefficient and expensive. In addition, he reiterated that the worldwide payments system is flawed and that the social media giant can correct this issue.

Marcus, who is also PayPal ex-president and Diem Association’s co-founder, emphasized how “change is long needed” and that given its inevitability, Novi is offering itself as that change.

He further stated how delaying the introduction of faster and more affordable digital payments is inequitable and unfair to users.

Diem stablecoins – what are they?

Diem Stablecoins is the brainchild of a nonprofit collaboration called the Diem Association. Set up in 2013, this nonprofit manages these stablecoins – a kind of cryptocurrency not unlike fiat currency, a central bank-issued currency that offers more stability.

Novi facilitates users’ deposit of payments into their digital wallets before converting them into Diem currency. It could, later on, be transferred globally to other consumers. As of now, the Novi is in its beta testing phase.

It has not been a smooth ride for Novi. It encountered several difficulties since Facebook initially proposed it under the name Libra. There were increasing concerns and questions over Facebook’s data privacy issues and possible money laundering problems. As a result, the launch of Libra was postponed.

Diem was initially intended to be backed by a diverse range of government debt and currencies, but it will now launch as a single investment backed by the United States dollar.

Marcus lauded the benefits of Diem, saying that “it would provide a substantial amount of value to people.” Additionally, since Facebook makes Diem, not only will it enable domestic and international transaction flows, it also benefits Facebook by generating wallet accounts.

The executive is confident that Novi will be a game-changer. He asserts that “the time has come to develop a transparent, interoperable system for internet money” to change radically how individuals and companies do business.

Facebook not a stranger to the payments business

Marcus states that Facebook is not a beginner in the payments industry. Instead, the social media giant has already been “a participant” in the payments business.

Facebook Payments is responsible for payment processing to the tune of $100 billion for the previous four quarters. Its presence and use are felt by consumers of 55 currencies and in more than 160 countries.

He also added that Novi has already obtained licenses and permissions in almost every state in the United States. The company will not debut in any states where its documentary requirements remain pending.

Furthermore, he said that the Diem Association communicates with regulators in the United States and worldwide. It is on its quest to create a “high-quality stablecoin” with comprehensive consumer safeguards, as well as a payments network that is highly compliant with US regulations.